AI Hedge Fund: Trade Like Wall Street’s Best

Design and backtest AI trading strategies visually - learn from legendary investors, zero coding required.

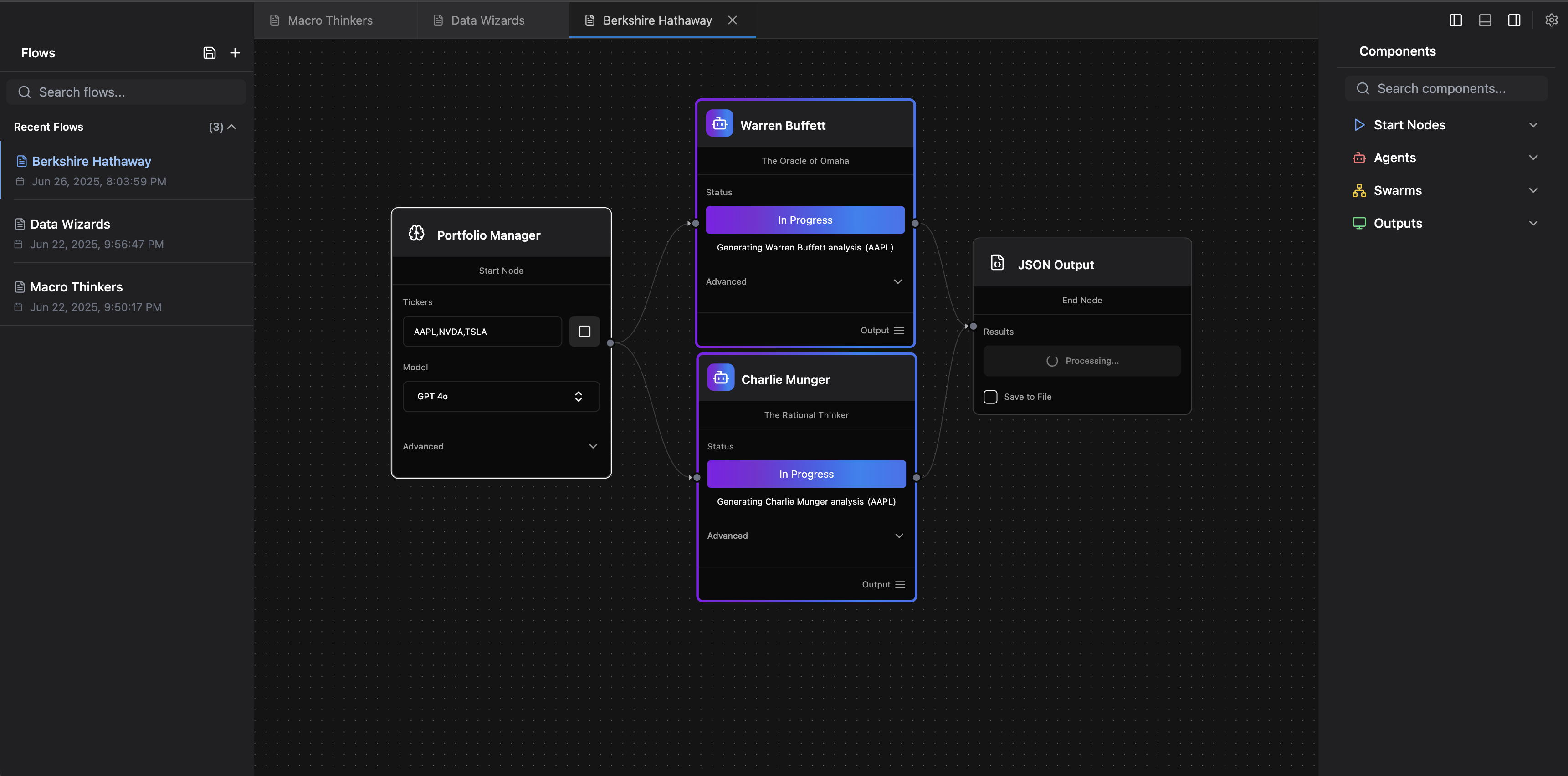

The AI Hedge Fund is an open-source platform for visually building, simulating, and analyzing AI-driven investment strategies. It offers a no-code interface to assemble workflows using diverse AI agents—from investor models (e.g., Warren Buffett) to specialized functions like sentiment or risk management. Users can run these strategies in a simulated environment, with real-time monitoring and historical backtesting. Primarily educational and research-focused, it helps understand AI fund mechanics and decision-making without live trading.

Core Value Proposition

Go from investment idea to a backtested AI strategy in minutes, not months. Visually assemble a team of AI analysts, define how they collaborate, and instantly test their collective performance against historical market data—all without writing a single line of code. This is your no-code platform for creating sophisticated, multi-agent financial intelligence.

| Field | Details |

|---|---|

| GitHub Repository | 🔗 virattt/ai-hedge-fund |

| Author | @virattt |

| Project Status | ⭐ 41.2k Stars · 🍴 7.3k Forks · 🔄 Active |

| License | MIT License |

Explore AI Hedge Fund in Depth

- AI Investor Agents - Meet your team of legendary investor AI models and specialized analysis agents

- Core Concepts - Understand backtesting, risk management, and multi-agent decision systems

- Vibe Coding Guide - Build your own AI trading platform with step-by-step prompts

Want to explore other AI projects? Check out our AI Town simulation or Perplexica search engine.

Highlight Features

- Visual Strategy Builder: Build your strategy like a flowchart. Drag and drop different AI agents—from value investors like Warren Buffett to contrarian thinkers like Michael Burry—and connect them to create unique decision-making pipelines.

- Instant Historical Backtesting: Test your AI team’s performance against years of real market data. See exactly how your strategy would have performed, complete with simulated trades (long and short), portfolio value changes, and key risk metrics like the Sharpe Ratio.

- A Roster of Investment Legends: Deploy a diverse team of pre-built AI agents, each modeled after a famous investor’s philosophy. Leverage the analytical styles of Cathie Wood, Peter Lynch, Stanley Druckenmiller, and more to create a balanced or aggressive approach.

- Transparent, Real-Time Execution: Watch your AI team work. Get a live, real-time feed as your agents analyze data, form opinions, and contribute to a final trading decision. Eliminate the black box and understand the “why” behind every action.

Target User Persona

This platform is designed for tech-savvy investors, quantitative analysts, and finance enthusiasts who want to experiment with and harness the power of AI in their investment process, but lack the time or deep engineering expertise to build the entire infrastructure from scratch.

Project Assessment

| Assessment | Analysis |

|---|---|

| Market Demand | Strong demand in the AI-finance intersection, validated by significant open-source community interest (41,000+ GitHub stars) and rising adoption of no-code AI tools in quantitative finance. |

| Technical Stack | Production-grade architecture combining React Flow for visual strategy design, FastAPI for real-time execution, and LangGraph for AI agent orchestration. Demonstrates modern best practices in full-stack AI applications. |

| Learning Value | Showcases practical implementation of multi-agent AI systems, real-time data streaming, and visual programming in finance. Valuable reference for building sophisticated AI applications with user-friendly interfaces. |

| Resource Requirements | Modular design allows scaling from local development (Ollama + SQLite) to production (Cloud LLMs + enterprise databases), with primary costs tied to market data APIs and inference. |